Summary

- Canadian dollar poised to test YTD lows on likely policy divergence.

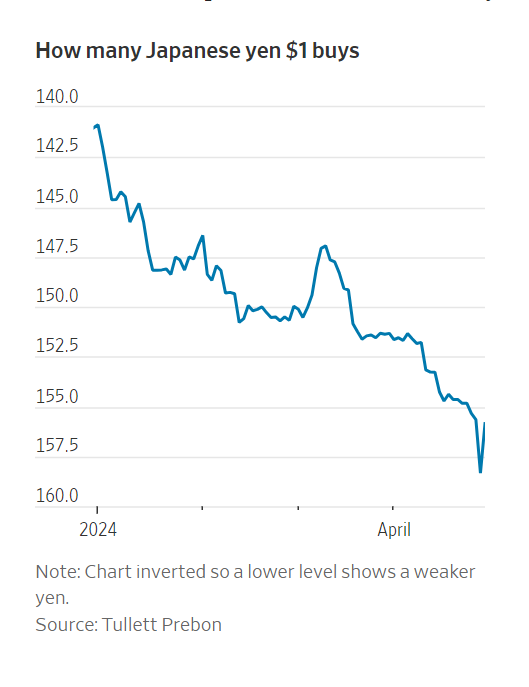

- Japanese yen has plummeted this year as traders shift bets on U.S. interest rates.

- U.S. 10-year yield remains elevated within recent ranges at 4.66%.

- U.S. April consumer confidence fell to 97.0; below all estimates around 104.0.

- Japan didn’t intervene in FX market up until April 25th, Ministry of Finance says.

- State Street says Japan can tolerate yen at 170 if movement slows.

- Bank of Japan accounts point to invention of about 5.5 trillion yen or roughly $35 billion USD.

- Mexico peso declines with peers after U.S. employment data; U.S. 1st Qtr. employment cost index rises 1.2% Qtr./Qtr.; estimate +1.0%.

- EUR/USD pares drop after euro-area CPI data.

- Norges bank to sell NK550 million a day of kroner in May.

- India’s rupee erases drop on likely U.S. dollar selling by banks.

Noteworthy

- Japan Intervenes After Yen Slides Against the Dollar

Japan intervened to prop up the yen after it hit a multidecade low against the dollar on Monday, people familiar with the matter said.

The currency has plummeted against the dollar this year, hurt by increasing doubts among traders about the timing of U.S. interest rate cuts.

The yen weakened to around 160 per dollar on Monday but bounced back to around 155 per dollar after Japanese authorities started buying yen and selling dollars, according to people.

Although Tokyo stopped short of confirming the move, Masato Kanda, the finance ministry’s top currency official, hinted at the intervention.

“It is difficult to ignore the bad effects that these violent and abnormal movements [in currencies] will cause for the nation’s economy,” said Kanda, adding that the government will continue to respond to wild currency moves.

The intervention came after weeks of speculation by traders that Tokyo was gearing up to help its beleaguered currency. Traders have turned increasingly bearish on the yen, which has stumbled despite a bull run in Japanese stocks and a wider improvement in the country’s economy.

It is unlikely to be the last time Japan intervenes in the currency market this year, given that U.S. interest rates are likely to remain high, said Alvin Tan, head of Asia foreign-exchange strategy at RBC Capital Markets.

“We will have a tug-of-war going forward between Tokyo and the market,” he said.

The decline of the yen shows the huge impact U.S. interest rates can have on foreign currencies. Although very few traders think the Federal Reserve is going to raise interest rates this year, they do think a series of highly anticipated rate cuts will be delayed—and that has sent the yen tumbling.

Japan’s ultra-low interest rates make its currency particularly vulnerable to changing U.S. rate expectations. The yen’s value has suffered for decades from "carry trades," where traders borrow in a currency with low rates and invest the money in a different country where returns are higher.

Japan is finally bringing an end to its long commitment to ultra-loose monetary policy—but only at a gradual pace.

The Bank of Japan (BOJ) became the last central bank to abandon negative interest rates in March. Some traders bet the yen would strengthen as a result. Instead, the currency has lost more than 9% of its value against the U.S. dollar this year, and wagers have started to pile up in the opposite direction.

The yen fell sharply Friday after the Bank of Japan left its interest rate target unchanged. BOJ Gov. Kazuo Ueda disappointed traders who were looking for hints about further rate increases.

Japan’s last official attempt to prop up the yen against the dollar was in October 2022, when the Ministry of Finance said it had bought yen that month worth around $41.1 billion in today’s exchange rate.

It was a public holiday in Japan on Monday, reducing trading volumes.

Contact Comerica Foreign Exchange

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.