Summary

- Canadian dollar pares losses after Bank of Canada leaves rates unchanged.

- The widely watched 10-year U.S. Treasury yield spikes up to 4.50% after stronger-than-expected March CPI.

- Hot inflation report derails case for Fed’s June rate cut.

- Euro currency falls most since July against U.S. dollar after U.S. CPI data.

- U.K. pound sterling slides to 2-month low as dollar surges on U.S. CPI data.

- Japanese yen breaches 152 per one U.S. dollar, raising risk of intervention.

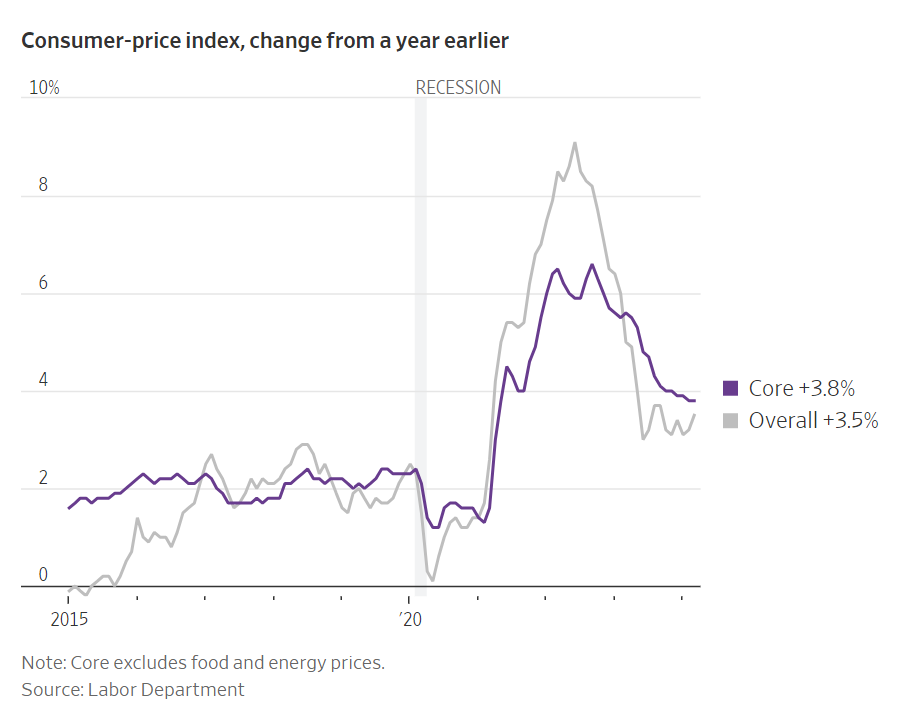

- U.S. March consumer prices increase 0.4% month-over-month versus 0.3% forecast (or 3.5% year-over-year against 3.4% expectation).

- U.S. March core consumer prices rise 3.8% year-over-year versus 3.7% estimate.

- Dow falls five hundred points as Treasury yields jump.

- Mexico peso drops after U.S. CPI; still outperforms peers.

- Kiwi dollar advances on hawkish RNBZ comment.

- EIA: Crude +5,841k Bbl, median estimate +800,000 Bbl.

- China bonds fall, CNY steady as Fitch cuts outlook.

Noteworthy

- U.S. Dollar Surges; Yen Plummets on Hot U.S. Inflation, Higher Yields

Stubborn inflation pressures persisted in March, derailing the case for the Federal Reserve to begin reducing interest rates in June and raising questions over whether it can deliver cuts this year without signs of an economic slowdown.

The consumer-price index, a measure of goods and services prices across the economy, rose 3.5% in March from a year earlier, the Labor Department said Wednesday. That was a touch higher than economists had forecast and a pickup from February’s 3.2%. So-called core prices, which exclude volatile food and energy categories, also rose more than expected on a monthly and annual basis.

Stocks fell, with the Dow Jones Industrial Average dropping about 500 points in morning trading. Yields climbed on U.S. government bonds, reflecting bets that the data could help delay and diminish future interest-rate reductions. The yield on the benchmark 10-year Treasury note breached 4.50% for the first time since November, according to Tradeweb, up from 4.36% Tuesday.

Futures contracts tied to the fed-funds rate show traders see rates ending the year around 5%, according to FactSet, implying just one or two quarter-point cuts this year. Entering January, traders expected the Fed to cut interest rates six or seven times.

“Inflationary pressures remain firm across the board,” said Blerina Uruçi, chief U.S. economist at T. Rowe Price’s fixed-income division. Inflation overall is “firmer than the Fed needs it to be to initiate a series of interest rate cuts anytime soon.”

Wednesday’s report had been hotly anticipated because Fed leaders had been willing to play down stronger-than-anticipated inflation readings in January and February as reflecting potential seasonal quirks. But a third straight month of above-expectations inflation data erodes that story and could lead Fed officials to postpone anticipated rate cuts until July or later.

Fed officials have been optimistic about achieving a so-called soft landing in which inflation slows without a sharp downturn in economic activity. To do that, some officials wanted to cut rates preemptively before the economy weakens notably. The latest report sets back that effort by depriving them of a credible justification for cutting rates, and it could prompt them to hold rates at their current level, the highest in 23 years, until they see more cracks in the economy.

Details within the report were just as concerning as the headline numbers, analysts said. The overall core index climbed 0.4% from the previous month despite a decline in the prices of goods such as new and used cars and trucks. A problem area was services outside of housing. That category, which includes everything from car insurance to medical care, has been flagged by Fed officials as particularly important because it can be sticky and closely linked to strength of the labor market.

The cost of shelter also increased 0.4% from February, continuing to defy predictions that it would start rising more slowly given private-sector indexes that have shown a marked slowdown in new rents.

Last month, a narrow majority of Fed officials thought at least three cuts would be warranted this year if inflation continued to fall. Fed Chair Jerome Powell has suggested he is on his front foot ready to cut rates but that the central bank shouldn’t be in a rush to do so.

“We’re in a situation where if we ease too much or too soon, we could see inflation come back, and if we ease too late, we could do unnecessary harm to employment,” Powell said last month. “We do see the risks as two-sided, so it is consequential” to start cutting rates.

Before Wednesday, many economists had also remained optimistic that inflation would resume its decline in March. But the latest data prompted Jonathan Pingle, chief U.S. economist at UBS, to anticipate the Fed would make its first cut in September instead of June and to make only two cuts this year.

Wednesday’s CPI report won’t be the final word on what prices did last month. The Fed’s preferred gauge, to be released later this month by the Commerce Department, has been running below the CPI. Core inflation using that measure was 2.8% in February.

By all measures, inflation has eased substantially since its peak in mid-2022, when CPI data showed that prices had climbed roughly 9% from a year earlier.

But Wednesday’s report reignited fears that the proverbial “last mile” of the inflation fight will be challenging. For example, core CPI had declined on a 12-month basis in every month since March 2023, when it stood at 5.6%, but that streak was broken with the latest price data.

“The key risk is not that inflation might rise…but rather that inflation will stall out and fail to follow the forecast path all the way back to 2% in a timely way,” said Dallas Fed President Lorie Logan last week. “In light of these risks, I believe it’s much too soon to think about cutting interest rates.”

Surveys suggest that Americans remain frustrated by the cost of living. Indexes of consumer sentiment have gradually improved but remain well below pre-pandemic levels. A recent Wall Street Journal poll of voters in seven of the most competitive states in the 2024 election found that 74% thought that inflation had moved in the wrong direction over the past year.

Contact Comerica Foreign Exchange

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.