Financial institutions have a reputation for being traditional, often considering new technology with a careful eye instead of immediately embracing it. This approach to technology in banking and financial services supports steady operations and positive outcomes for customers.

Leading organizations in the banking industry regularly review emerging financial technology and identify potential opportunities for use — as long as it is secure, dependable and generally fit for its intended purpose, of course.

Innovations like the ATM, which provide access to cash for individuals and businesses outside of regular banking hours was revolutionary for its time, although it is now often taken for granted. Online banking and mobile banking, which further extend access to important information and key actions on a 24/7 basis, are two more recent examples of the same concept.

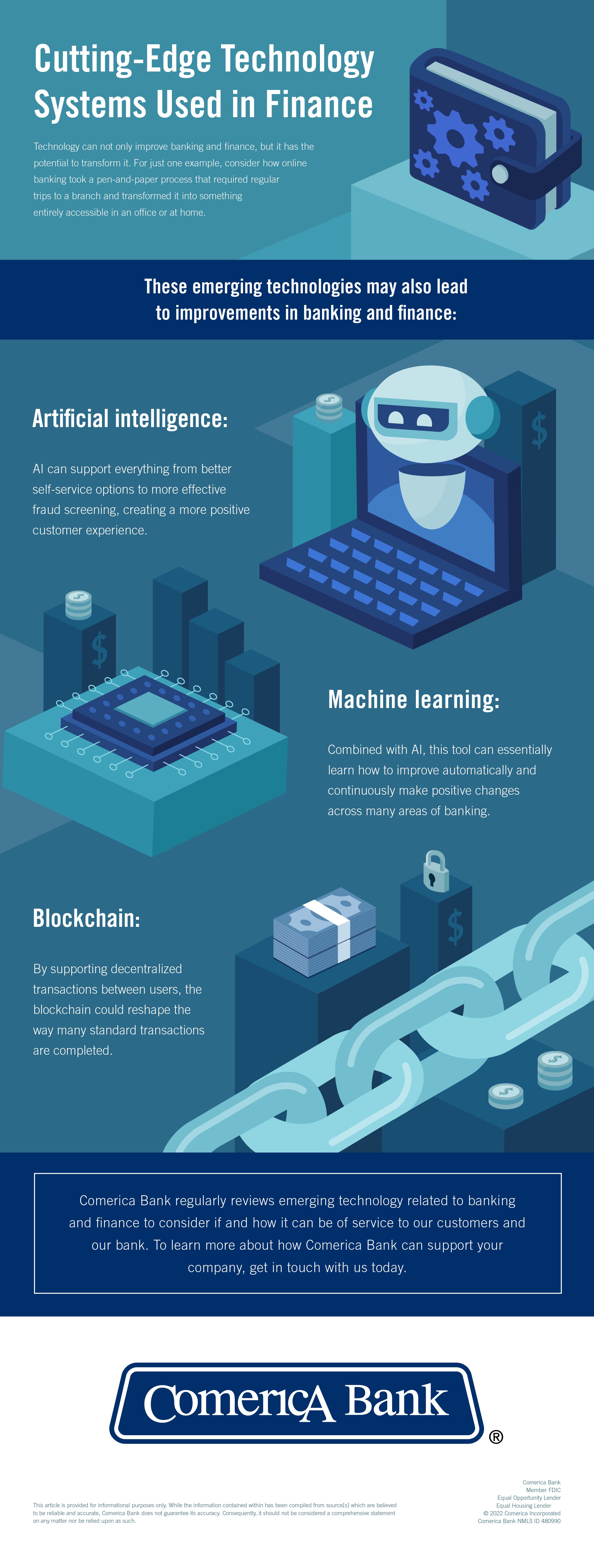

Our infographic, “Cutting-Edge Technology Systems Used in Finance,” looks at three tools that are being adopted to various degrees by financial institutions and other organizations in the banking and finance space.

In it, we touch on artificial intelligence, machine learning and the blockchain as examples of technology that have already proven their worthiness to some degree, but still leave room for additional innovation. These tools are already making the business of modern banking easier, in certain contexts.

Comerica Bank prioritizes the effective and secure use of proven technology to enhance our banking and financing services. To learn more about how we can support your business, get in touch with us today.