Preview of the Week Ahead

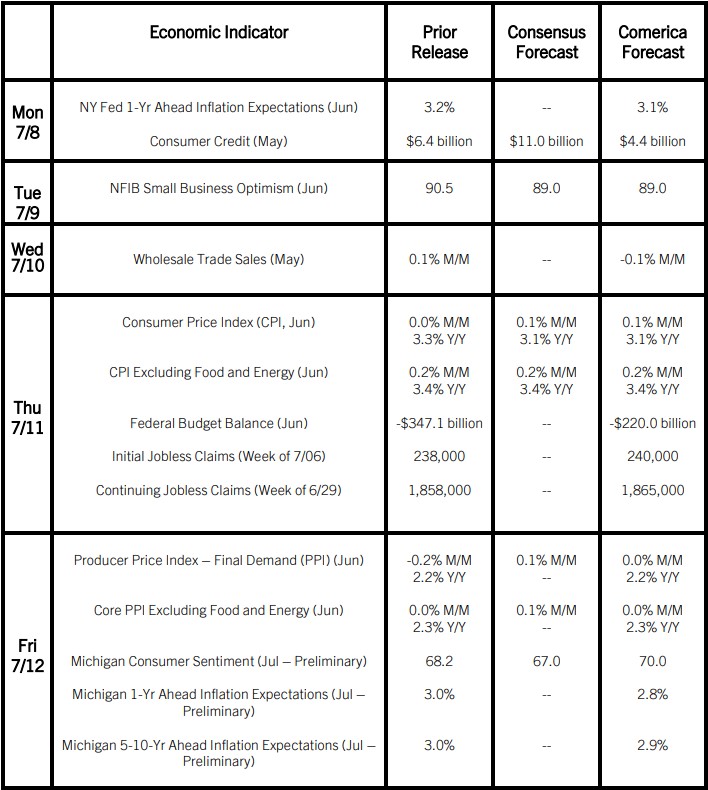

The CPI and PPI reports will likely show inflation moved sideways in June despite the month’s lower prices of gasoline, diesel, and used cars. Inflation slowed sharply in the second half of 2023, so unless inflation slows even more dramatically in the next few months, the headline year-over-over measure of prices is likely to hold little changed. Shelter costs are an exception, and likely rose at a slower year-over-year pace in June than in May.

The fiscal deficit likely narrowed in June, in part reflecting typical seasonality of revenues and outlays. Wholesale sales likely dipped in May as lower petroleum prices weighed on revenues. Consumer sentiment likely improved in the July preliminary survey as consumers became a little less downbeat about the effect of inflation on their household finances.

The Week in Review

Job openings rose to 8.140 million in May from a downwardly-revised 7.919 million vacancies in April, with government job openings accounting for four-fifths of the net increase. The number of quits, at 3.5 million, and the quits rate of 2.2% held steady for the seventh consecutive month. The quits rate is below the February 2020 level of 2.3%. With fewer unfilled job openings, employees see fewer opportunities to improve their prospects in a new job.

The Institute of Supply Management’s surveys of services and manufacturing unexpectedly fell in May and were notably weaker than consensus forecasts. The ISM Services PMI fell 5.0 percentage points to 48.8. Key details of the report are troubling: There were sharp declines in production and new orders; and employment contracted at a faster pace. The ISM Manufacturing PMI eased by 0.2 percentage points to 48.5. All five constituent components of the index—production, new orders, employment, supplier deliveries, and inventories—were in contractionary territory last month. On a positive note, input prices in the manufacturing and services sectors rose at a slower pace.

The trade deficit in goods and services widened to $75.1 billion in May from $74.5 billion in April, as exports fell at a faster pace than imports. The real deficit in goods widened to around 9% in the first two months of the second quarter compared to the first. Net exports is likely to weigh on real GDP in the second quarter.

The U.S. economy added 206,000 nonfarm payroll jobs in June, but job growth in April and May was revised down a large 111,000. After revisions, job growth over the last year averaged a cool 150,000, considerably slower than the 230,000 12-month average in the May jobs report. The unemployment rate rose to 4.1% in June from 4.0% in May and was the highest since November 2021. Average hourly earnings growth slowed to 3.9% from 4.1% and was the least since June 2021, though likely still faster than June’s increase in the CPI.

For a PDF version of this publication, click here: Comerica Economic Weekly, July 8, 2024(PDF, 173 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.