Preview of the Week Ahead

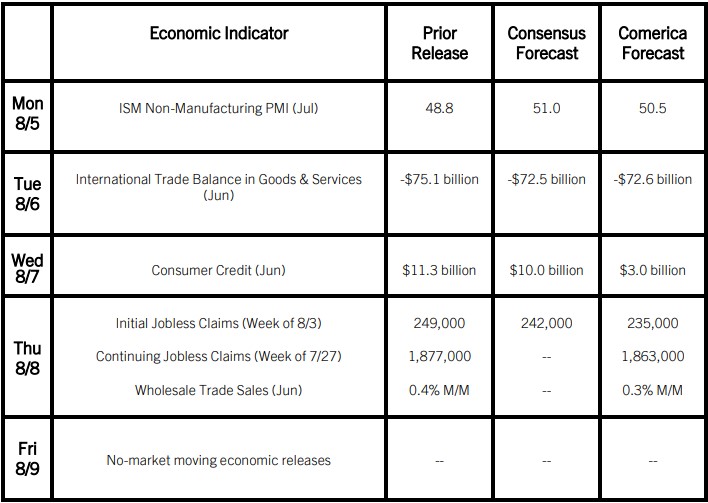

In a light week for economic data, the highlight will be the ISM Services PMI’s July release. The survey is likely to show a return to modest growth of the less cyclical service-providing sector in July after it slipped into contraction in June.

Consumer credit likely rose more slowly in July than June. Low- and moderate-income consumer finances are under strain from the high cost of living, and consumers who relied on credit in 2022 and 2023 to fund their spending have less capacity to borrow in 2024. Higher-income households are in good financial shape, but hesitate to take on loans given high interest rates.

Wholesale trade sales likely rose moderately in June on higher production volumes and prices of domestically-produced petroleum prices, as well as increased shipments of transportation equipment and other durable goods.

The Week in Review

The Federal Open Market Committee (FOMC) unanimously voted to hold the federal funds target unchanged at 5.25% to 5.50% at their July 31st meeting. After focusing on achieving their 2% inflation objective for over two years, the FOMC tweaked their forward guidance to indicate that they will also be attentive to their maximum sustainable employment mandate, signaling more openness to cutting rates. When asked specifically about a cut at the next meeting, Chair Powell noted that he believed a rate cut in September “could” be warranted if inflation continues to ease, economic growth remains reasonably strong, and the labor market remains around its present state.

The July jobs report was weak across the board. Nonfarm payrolls rose by a modest 114,000, well below the 175,000 consensus. The prior two months’ employment figures were revised lower by a combined 29,000. Roughly half of July job gains were in a single sector: healthcare. The unemployment rate unexpectedly rose by 0.2% to 4.3%, but, on a positive note, that was largely due to temporary layoffs. The average workweek slipped to 34.2 hours, 0.1 hour below its long-term average. The labor force participation rate increased by 0.1 pp to 62.7%. Average hourly earnings rose modestly by 0.2% on the month and 3.6% from a year earlier, the slowest increase since mid-2021. Job openings fell by a marginal 46,000 to 8.184 million in June. Private sector openings declined broadly; public sector vacancies rose, all in state and local government. Along with fewer job openings, the quits rate, a widely followed proxy for employees’ ability and willingness to change jobs, held steady for the second consecutive month and was below its February 2020 pre-pandemic level.

The ISM Manufacturing PMI declined again by 1.7 percentage point to 46.8% in July. Its three key subindices—production, new orders, and employment—all fell further into contractionary territory. Stock prices and long-term bond yields fell after release of the weaker-than-expected ISM PMI survey and jobs report, fearing that the economy is weakening more than anticipated in the Fed’s base case.

For a PDF version of this publication, click here: Comerica Economic Weekly, August 5, 2024(PDF, 123 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.