Florida’s Economy to Grow Faster than the U.S. Economy Again in 2025

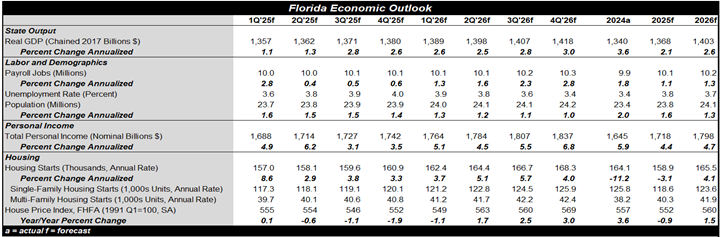

Following robust economic growth of 3.6% in 2024, the Floridian economy is expected to grow at a slower pace in 2025, but still outperform the national economy. The Sunshine State’s employment growth, which was the fastest for any large state in recent years, is expected to moderate in 2025, as hiring slows in the critical agriculture and tourism sectors. While the unemployment rate is anticipated to rise, it is, nonetheless, expected to be markedly lower than the national unemployment rate. Job opportunities in the Sunshine State are projected to pick up in the second half of 2025 and into 2026 on the back of fiscal stimulus and greater clarity on international trade. A rebound in job openings, along with the long-standing draws of low taxes, mild winters, and housing that’s more affordable than the Northeast, are expected to contribute to another solid year of population gains.

A cooler labor market and more modest growth in household income from dividends and interest will likely translate to moderate growth of incomes for Floridians in 2025. The outlook is expected to brighten next year in line with a rebound in the labor market, tax cuts, and reduced trade policy uncertainty as trade deals are negotiated and signed.

Housing construction and sales are expected to remain soft with homebuilder sentiment subdued and affordability strained by high house prices and mortgages rates. Also, listings of existing homes have risen in the first half of 2025, limiting demand for new construction. Tariffs on softwood lumber and other construction materials are additional headwinds for the sector. Single-family construction is projected to add around 120,000 units to Florida’s housing supply in 2025. After falling sharply in the prior two years, multifamily construction is off to a flying start in 2025. Multifamily demand will be supported by laws that discourage buyers looking at older multifamily units. High single-family housing costs in much of the state are a further support for multifamily housing demand. On the back of the aforementioned, around 40,000 units are forecasted to be added in 2025. Reflecting increases in supply, slower employment growth, and more moderate income gains, house prices are forecast to pull back slightly in 2025, then return to increases in 2026; affordability will improve over the forecast horizon. High insurance costs and fewer insurers participating in the state’s housing market are ongoing challenges to the industry.

For a PDF version of this publication, click here: Florida Mid-Year State Economic Outlook(PDF, 139 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.