Summary

- German elections usher in conservative Friedrich Merz but possible 25% U.S. tariffs could make for a rocky start.

- U.S. Consumer Confidence declined to the lowest point since August 2021.

- President Trump re-affirmed 25% tariffs to be imposed on Canada and Mexico on March 4.

- Positive U.S. economic data helped the U.S. dollar end the week with a positive tone.

- The ‘Mar-a-Lago Accord’ could result increased U.S. dollar volatility.

German Elections

Last Sunday, Germany’s Fredrich Merz is set to become Germany’s next Chancellor. While he fell short of gaining a coalition, his party won enough seats in the new parliament to work with European allies with the Ukraine war and shore up a struggling German economy. One of Merz’s immediate challenges could be with U.S. President Trump. While Merz and Trump come from the conservative side of their respective political spectrums, Trump’s overtures towards the European Union (of which, Germany is the largest member) will be challenging. On Wednesday, Trump mentioned a possible 25% tariff on European Union imports into the U.S. and other incendiary remarks how the European Union is not a fair trading partner with the U.S.

Strengthing U.S. Dollar

This week the U.S. dollar moved higher on a combination of factors related to the market’s perception of a weakening U.S. economy, Fed speakers point to keeping interest rates steady and tariff talk from President Trump.

On Tuesday, the Conference Board’s Consumer Confidence declined by seven points in February to 98.3. This is the third straight monthly decline and the lowest level since August 2021. Declining U.S. Consumer Confidence usually equates to slower economic growth. “References to inflation and prices in general continue to rank high in write-in responses” said Stephanie Guichard with the Conference Board. She went on further to say, "Most notably, comments on the current administration and its policies dominated responses."

On the back of this data, U.S. 10-year yields declined as the market took into account of the possibility (putting another 0.25% interest rate cut by the U.S. Federal Reserve Bank back the table. While at the same time, Raphael Bostic (President, Atlanta Federal Reserve) said the ‘Fed should hold interest rates where they are, at a level that continues to put downward pressure on inflation.’ Also, Tom Barkin (President, Richmond Federal Reserve) said ‘It makes sense to stay modestly restrictive until we are more confident inflation is returning to our 2% target.”

The combination of these factors mid-week helped stop the U.S. dollar’s down trend since the beginning of the year. However, U.S. dollar strength emerged as President Trump’s re-affirmed the implementation of 25% tariffs on Canada and Mexico that are set to go into effect on March 4th. Thursday’s stronger than expected U.S. economic data (Gross Domestic Product, Durable Goods Orders, and Initial Jobless Claims) swung some market participants to factor in the Federal Reserve Bank will slow down the pace of interest rates cuts later this year.

Today, the Federal Reserve Bank’s preferred inflation measure, Personal Consumption Expenditures (PCE) price index rose 0.3% from December and 2.6% from last year offering some relief on the inflation front.

Mar-a-Lago Accord : Potentially Plaza Accord 2.0?

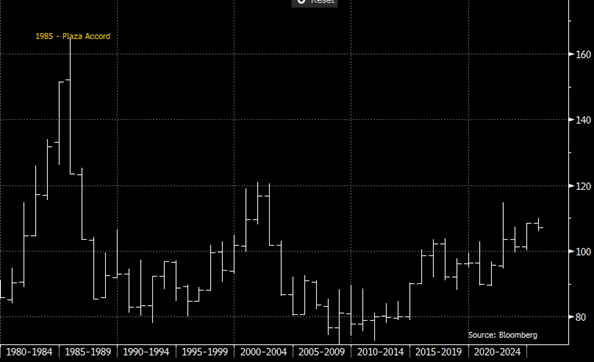

One of the interesting ideas floating around in the financial press gaining coverage is something called the “Mar-a-Lago Accord”. Named after President Trump’s residence in Florida, parallels are being made between the Trump administration possibly abandoning the long-held U.S. strong dollar policy to help reverse the course on the U.S. trade deficits with most of its major trading partners and the Plaza Accord in 1985.

The Plaza Accord was an agreement between the U.S., Japan, West Germany, France and the U.K. to depreciate the U.S. dollar to correct trade imbalances, particularly the U.S. trade deficit by making U.S. exports more competitive. One of the main monetary policy tools used was central bank intervention. The central banks of the U.S., Japan, West Germany, France and the U.K over a period of time sold the U.S. dollar to drive it lower.

To see this effect on the value of the dollar, see the below chart of the U.S. dollar index.

President Trump’s nominee to head the White House Council of Economic Advisors (Dr. Stephen Miran - yet to be confirmed by the U.S. Senate) published a white paper on November 12, 2024 entitled ‘A User’s Guide to Restructuring the Global Trading System’. Dr. Miran currently is with Hudson Bay Capital (a hedge fund) and previously served as a senior advisor to the U.S Treasury during President Trump’s first term. He also comes with an academic pedigree with a Ph.D in economics from Harvard.

In this thirty-eight-page white paper, Dr. Miran argues the effect of President Trump’s anticipated tariffs will drive up the value of the U.S. dollar. To counteract this, the U.S. administration should consider policy tools both multilaterally and unilaterally that would drive down the U.S. dollar. In the conclusion of the white paper, he says ‘There’s a path by which the Trump Administration can reconfigure the global trading and financial system to America’s benefit, but it is narrow, and will require careful planning, precise execution, and attention to steps to minimize adverse consequences.’

It seems U.S. Treasury Secretary Scott Bessent might share similar sentiments. This past June before Trump’s election, he was quoted as saying ‘some kind of grand economic reordering’ might be needed in the coming years.’

In the United States, to execute foreign exchange intervention, the U.S. Treasury instructs the Federal Reserve Bank. From there, the Federal Reserve Bank intervenes in the foreign exchange markets. The head of the U.S. Treasury reports to the President of the United States.

As the Trump presidency has demonstrated the pathway from idea to execution (or at least pending execution) can be quick, the summoning of U.S. intervention in the foreign exchange markets to counteract the unwanted effects of tariffs or other trade policies could have an effect of increased U.S. dollar volatility.

Contact Comerica Foreign Exchange

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.