Noteworthy

- Dollar Erases Brief Gain After U.S. CPI; Euro, Pound, Yen Weaken

- U.K. Pound Sterling Touches 3-Month Low as GDP Data Weighs on Sentiment

The U.S. Dollar

U.S. inflation accelerated in August due to a jump in gasoline costs, but underlying price pressures were likely mild enough to keep the Federal Reserve on track to hold interest rates steady next week.

The consumer-price index, a measure of goods and services prices across the U.S. economy, rose 0.6% in August from the prior month, a faster pace than in July as gasoline prices jumped, the Labor Department reported Wednesday.

Prices rose 0.3% when stripping out the volatile categories of food and energy, a hotter pace for so-called core inflation than the prior two months. The uptick in core prices reflected higher costs for items such as rent, vehicle insurance and medical care, the Labor Department said.

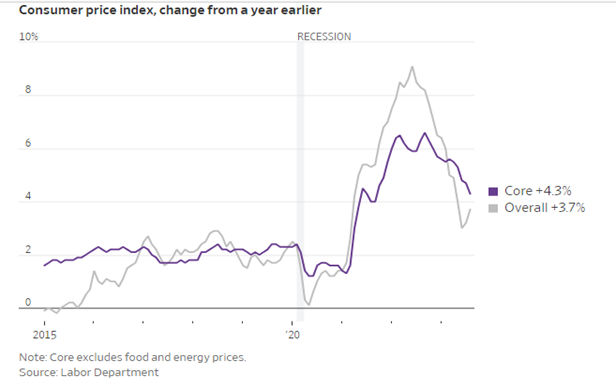

On an annual basis, prices overall were up 3.7% in August versus 3.2% in July. Annual core inflation edged lower to 4.3% in August from 4.7% the prior month.

Fed officials signaled last week they were preparing to hold interest rates steady at their meeting next week, and Wednesday’s inflation report isn’t likely to change that outcome. Whether it is enough to lead officials to raise interest rates again in November or December largely depends on whether inflation increases in the coming months.

While slowing price increases across several categories earlier in the summer were a sign that the Fed has made progress in cooling inflation, the central bank is like a football team trying to punch in a score after a long drive, said Stephen Juneau, senior U.S. economist at Bank of America.

“You still have to cross into the end zone, and that can sometimes be the hardest thing to do,” he said.

A big question is whether a step down in price pressures that began in June will be sustained. Officials are wary about prematurely declaring that inflation has slowed. At times in 2021 and 2022 it appeared that price pressures were easing only for inflation to reaccelerate.

Reviewing a shorter time frame to show the most recent trends has shown an even more marked slowdown in core inflation. The core CPI index over the three months through August rose at a 2.4% annual rate, down from a 5% annual rate for the preceding three-month period.

“We have to wait and see if this inflation trend is continuing,” Fed governor Christopher Waller said last week on CNBC. Officials have been burned twice before, in mid-2021 and again last year, when it looked like inflation had peaked only to see it rise again.

“I want to be very careful about saying we’ve kind of done the job on inflation until we see a couple of months continuing along this trajectory before I say we’re done doing anything,” Waller said.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.