Noteworthy

- Hiring Slowdown First Warning Sign of Cooling Economy

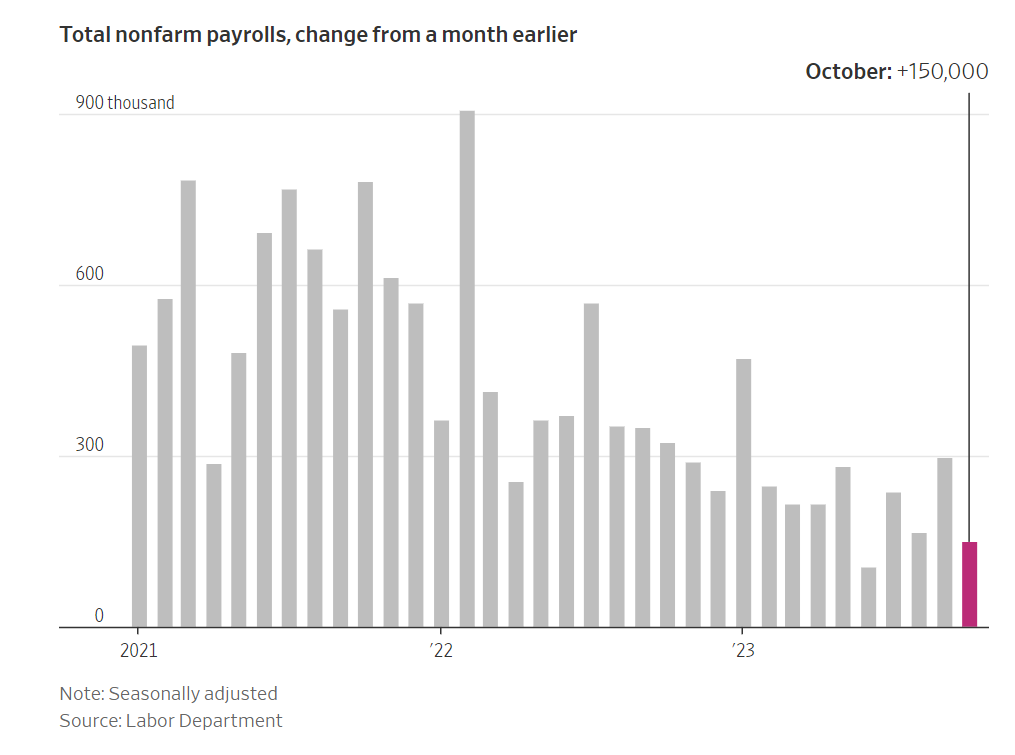

Hiring slowed sharply in October, a sign the economy is cooling this fall following a hot stretch over the summer.

U.S. employers added 150,000 jobs in October, down from the previous month’s revised gain of 297,000, the Labor Department said Friday. That was the smallest gain since June, with automakers having around 33,000 fewer workers on payroll because of the United Auto Workers strike. The unemployment rate rose to 3.9% from 3.8% the prior month.

The figures could bring the Federal Reserve’s historic interest-rate increases to an end by providing stronger evidence that higher borrowing costs have slowed the economy.

Fed officials have raised rates at the most rapid pace in decades and to a 22-year high to bring inflation under control. Since raising them in July, they have held rates steady, including at their meeting this week, as price pressures eased. But officials have been unwilling to declare a firm end to increases and signaled this week their next move was more likely to be an increase than a cut.

U.S. stocks rose and Treasury yields fell. Investors were hoping for an easing of job gains as a sign that the economy is slowing, and the Fed can stop tightening.

Friday’s report showed wage growth cooled as employers hired less. Average hourly earnings rose 4.1% from a year ago, the department said, down from 4.3% in September. The share of people working or looking for work fell slightly to 62.7% in October from 62.8% in September.

Friday’s report showed wage growth cooled as employers hired less. Average hourly earnings rose 4.1% from a year ago, the department said, down from 4.3% in September. The share of people working or looking for work fell slightly to 62.7% in October from 62.8% in September.

“Wage growth cooled further in the October jobs report, paralleling the slower increase in ADP’s estimates of private wages and evidence from surveys like the Fed’s Beige Book. This echoes the slowdown of the employment cost index and unit labor costs released earlier this week and will make the Fed more confident that the job market will contribute less to inflationary pressures in 2024” said Bill Adams, chief economist at Comerica Bank.

The report “is another sign that the economy’s strength in the third quarter is likely to unwind in the fourth,” said Andrew Hunter, deputy chief U.S. economist at Capital Economics. “With wage growth also continuing to slow, it is increasingly hard to imagine the Fed hiking interest rates any further.

Healthcare industries and governments added more than 50,000 jobs each in October while transportation and warehousing lost 12,000. Employment was also down in the information industry, partly reflecting the strike by TV and film actors.

Forecasters predicted 2023 would be a recession year in the U.S., as Americans faced higher borrowing costs. Instead, the economy has been solid, even picking up in recent months. Gross domestic product grew in the third quarter at the fastest rate since 2021, propelled by robust consumer spending.

One reason for the economy’s resilience has been the strong labor market, which has kept creating jobs despite higher borrowing costs and a volatile global situation with wars in Europe and the Middle East. That allowed Americans to keep up their spending.

Forecasters in a Wall Street Journal survey and at the Fed now say they see the economy avoiding a recession and gradually slowing to a pace that keeps inflation under control.

The strong labor market is encouraging people to come off the sidelines and look for a job, enticed by the prospect of higher wages and benefits. The share of working-age people either working or looking for a job has climbed, and recently hit the highest level in more than two decades.

Having more people in the workforce could make it easier for employers to find workers, which would keep wage growth and inflation in check. When wages rise rapidly, in theory, it forces businesses to increase their prices to pay for higher labor costs.

On Wednesday, Fed Chair Jerome Powell pointed to the cooling labor market as one reason the central bank might not need to raise rates further. He said higher labor-force participation and the recent rebound in immigration following the pandemic shutdowns as encouraging signs the economy could continue to prosper without pushing up consumer prices.

“What we’ve seen is a very positive rebalancing of supply and demand, partly through just much more supply coming online,” he said. That is helping to bring down wage growth “in a kind of gradual way.”

The Fed last raised its benchmark interest rate in July. Signs that wage growth is slowing could allow the Fed to extend its pause in rate increases into next year, while signs that the labor market is tightening further could lead some officials to worry that recent declines in inflation might reverse. Those policy makers might argue for the Fed to raise interest rates as soon as its next meeting, Dec. 12-13.

There are signs, however, that the job market could lose momentum in 2024. Both the number of new hires and the number of people who voluntarily quit their jobs trended down since the beginning of last year, while the number of layoffs has held steady, according to the Labor Department.

Those trends suggest that the labor market is becoming more stable, with less turnover, as uncertainty about the future prompts employers and their staff to decide that now isn’t the time to make big changes.

“Head count is growing, but that’s because the water is draining out of the bathtub more slowly, not because there’s a lot of new hiring taking place,” said Julia Pollak, chief economist for ZipRecruiter, an online job board.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.